| Nest egg |

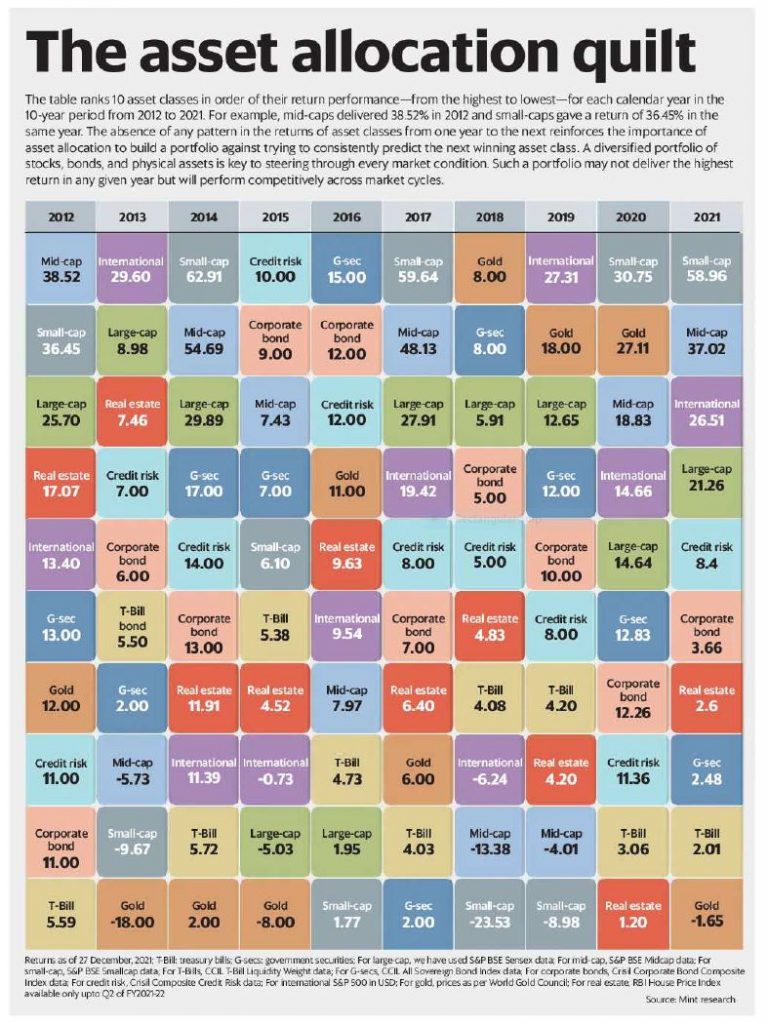

On Dec 28, 2021 mint published the past return of different investment assets. It gives us why we should diversify our investment in different assets based on market conditions. Investing equity is important in long term wealth creation. But diversifying the investment in different assets would reduce risks and help in liquidity in case of emergency. This blog we will discuss everything you need for Wealth creation

From this chart, we can realize why is it important to have Gold, corporate bonds and Gilt funds in our asset allocation. To get 15% returns from our assets, it is important to have better diversification.

Do not search your favorite LIC insurance, PPF and Fixed deposits in this chart. LIC insurance, PPF and fixed deposits are saving instrument and not an investment. PPF return rate is 7% annually and annual inflation rate is 5% in India. Still you think LIC and FD are investment, I completely agree with you.

LIC insurance, PPF and fixed deposits are saving instrument and not an investment.

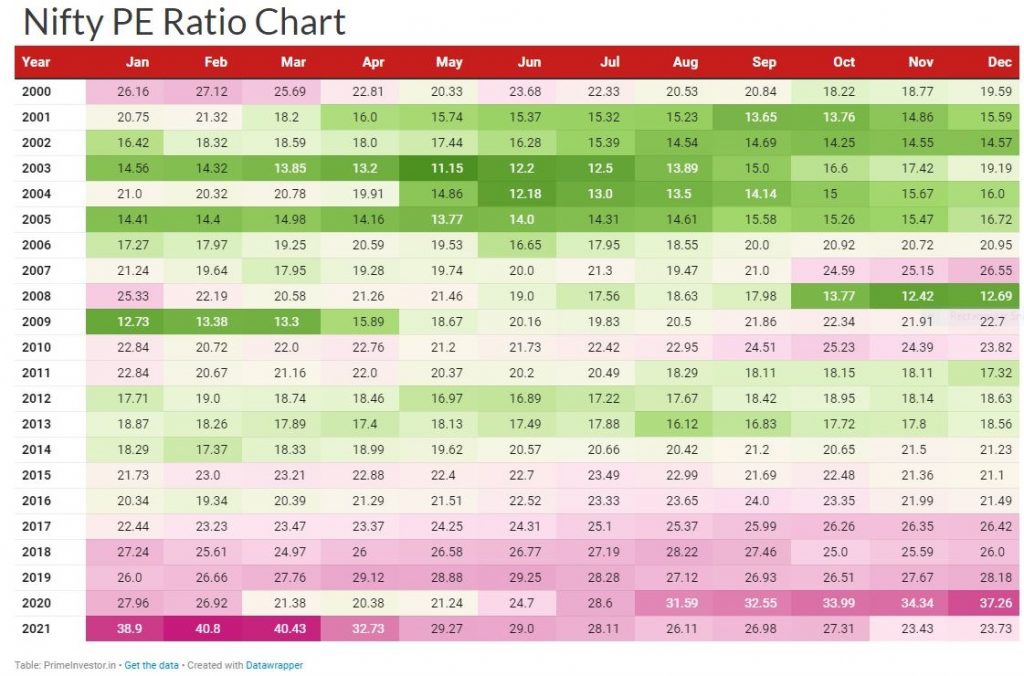

Price to Earning ratio(P/E) :

The price-to-earnings (P/E) ratio of market is that market companies share price to its earnings per share. It helps to identify the market is overpriced or average price or underpriced. India SENSEX recorded a daily P/E ratio of 27.630 on 30 Dec 2021. The P/E ratio reached an all-time high of 57.420 in Apr 1992 and a record low of 9.830 in Nov 1998. You can find the P/E ratio of Indian market in primeinvestor or in google. It is available for free and gets updated daily.

How P/E ratio would help you to take a decision on your investment:

P/E ratio is 26 to 30 => Very Expensive (Screaming Sell)

21 to 25 => Expensive(Wait and watch)

16 to 20 => Average (Buy)

12 to 15 => Inexpensive ( Screaming buy)

Below 12 => Buy, buy, buy. Rare chance. if you miss, you be called as fool.

You can compare your equity(stocks or equity mutual funds) investment made in different time and compare with P/E ratio. The investment made when P/E is low might have provided high returns in long term. Thanks to PrimeInvestor for this valuable chart.

Today India SENSEX P/E ratio is 27.630 on 30 Dec 2021

Here is the list of top mutual funds in each category to start with. Best mutual funds to invest in 2022.

Top Large cap Funds:

- Axis Bluechip Growth Direct Plan

- UTI Nifty Index Growth Direct Plan

- IDFC Nifty Growth Direct Plan

Top Mid Cap Funds:

- Axis Mid Cap Growth Direct Plan

- Quant Mid Cap Growth Direct Plan

- ICICI Prudential Nifty Next 50 Index Growth Direct Plan

Top Small Cap Funds :

- Axis Small Cap Growth Direct Plan

- Motilal Oswal Nifty Smallcap 250 Index Growth Direct Plan

Best Credit Risk Funds:

- ICICI Prudential Credit Risk Fund

- HDFC Credit Risk Debt Fund

Best Government securities fund(Gilt Fund):

- SBI Magnum Gilt Growth Direct Plan

- ICICI Prudential Gilt Growth Direct Plan

Top Gold Funds:

- Kotak Gold Growth Direct Plan

- SBI Gold Growth Direct Plan

Top Corporate Bond Funds:

- HDFC Corporate Bond Growth Direct Plan

- L&T Triple Ace Bond Growth Direct Plan

Best International funds :

- Motilal Oswal S&p 500 Index Growth Direct Plan

- Franklin India Feeder Franklin US Opportunities Growth Direct Plan

Top Focused and ELSS Funds:

- SBI Focused Equity Growth Direct Plan(Midcap + Focused)

- Tata Digital India Growth Direct Plan(Midcap + Technology)

- Quant Infrastructure Growth Direct Plan(Midcap + Infrastructure)

- ICICI Prudential Technology Growth Direct Plan (Midcap + Technology)

- Axis Long Term Equity Growth Direct Plan (Large Cap + Tax Savings 80C)

- IDFC Tax Advantage Growth Direct Plan(Large Cap + Tax Savings 80C )

Comparing the P/E ratio and investing in respective assets only for lumpsum investment. In case of your monthly SIP in equity mutual funds, there is no worry on P/E ratio as long term investment takes care by rupee cost average. You can start your SIP anytime on any of mutual funds for your financial goals.

Top mutual funds to invest in 2022. Best mutual funds to invest in 2022. Happy New year 2022.