Identifying the investment instrument is very simple. The investment which beats inflation rate 5% is best investment for wealth creation. Fixed deposit and insurance can’t be considered as investment against inflation. Investing in hard assets gives better returns. Gold, Real estate, Stocks and mutual funds investment are considered investment. Common rule in investment is that investments which beats inflation never give fixed returns and it is associated with risk.

Not taking risk in investment is biggest mistake in wealth creation.

In this blog, let us discuss easily accessible investment technique which works for 85% Indians. There is potential possibility to earn high in stock investment. But it requires knowledge in equity market, company financials and understanding of the business. It requires time and effort. Only 4% of Indians come in this category and they earn high in stock market. For rest of us, there is easy and better option: Mutual funds.

There are 100 of active mutual funds and few index mutual funds. Selecting active mutual funds require detailed analysis of the investment style of the fund. The investment style, expense ratio, fund return vs Index returns, fund returns vs peer returns. Understanding of basic mutual funds is required to start investment in active mutual funds. There is another category of mutual funds, index mutual funds. Index funds are less expensive, associated with Nifty returns. Easily accessible and simple to select as all the index mutual funds investment style is same except the fund house.

Nifty index funds :

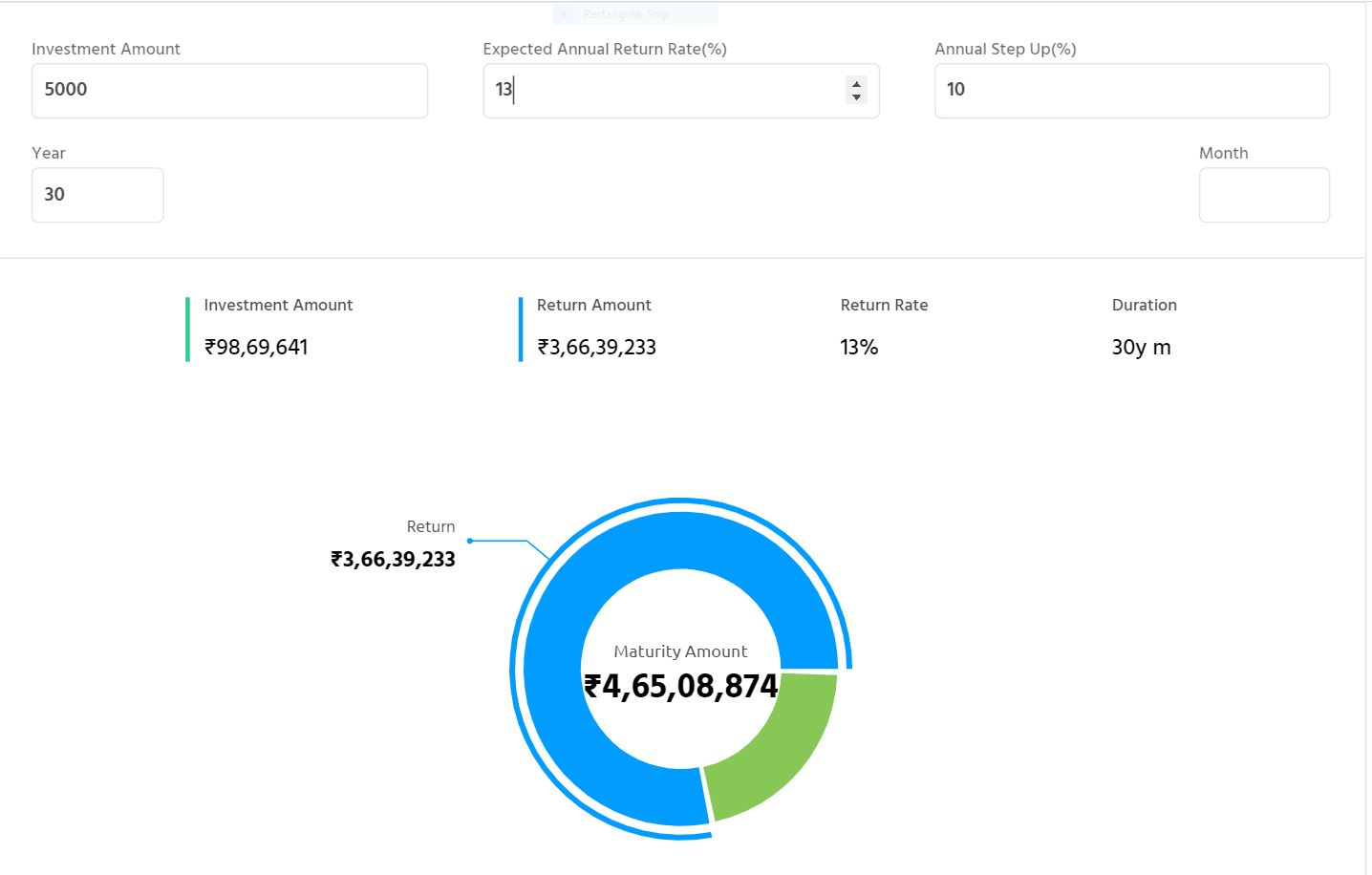

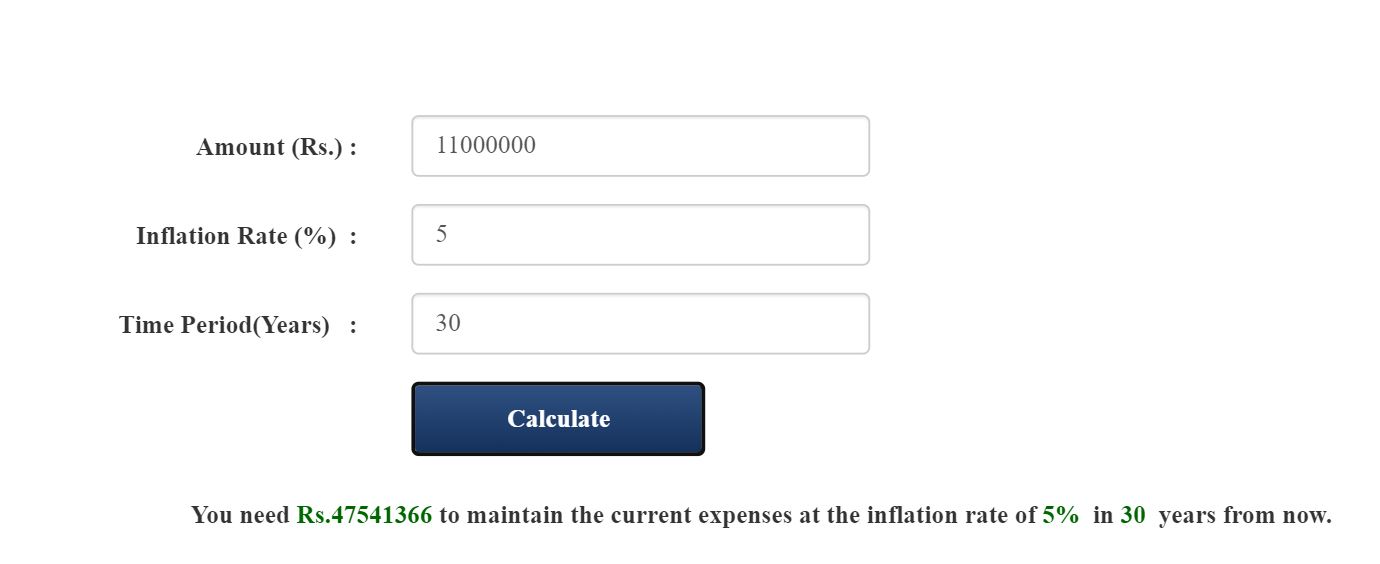

You can start investment of monthly 5000 in mutual fund SIP. Invest 3000 rupees in Nifty 50 index mutual funds, 2000 rupees in Nifty Next index fund. It would provide 13% return in long term. Increase your investment by 10% in each year in SIP. First year monthly 5000, second year monthly 5500, third year monthly 6100…….. Increasing each year by 10% in SIP would give 5 crores after 30 years. Nifty average return is 12% in long term.

The return would be approximately 5,00,00,000. With annual inflation of 5%, it would be equal to 1.2 crore of today. 1.2 crore would be helpful for your retirement, your son’s marriage or your dream house. Starting with 5000 rupees would grow to 5 crores in 30 years.

Nifty Index mutual funds :

Select any one of below mutual funds and invest 3000 rupees in monthly SIP in first year. Every year increase your SIP by 10%. Nippon India allows to start monthly SIP of 100 rupees. So first year you can invest 3000, second year 3300, third year 3700,…….. These mutual funds invest in Nifty 50 index. UTI index mutual funds has long history and less expensive. You can start invest in UTI mutual funds by login to UTI mutual fund portal. In case you are existing customers of SBI, HDFC or ICICI, you can start your mutual funds by login to respective mutual funds portal.

- UTI Nifty Index Growth Direct fund (Expense ratio : 0.1%)

- HDFC Index Nifty 50 Growth Direct Fund (Expense ratio : 0.1%)

- ICICI Prudential Nifty Index Growth Direct fund(Expense ratio : 0.1%)

- Nippon India Index Nifty Growth Direct fund(Expense ratio : 0.1%)

- SBI Nifty Index Growth Direct Fund(Expense ratio : 0.29%)

- IDFC Nifty Growth Direct fund(Expense ratio : 0.24%)

You start invest 2000 rupees in Nifty junior index. It invests in Nifty next 50 stocks. This would invest in 50 growing companies in nifty such as dabar, Aurobindo pharma and many more. You can start investing in this fund by login to UTI mutual funds portal or ICICI mutual fund portal. Select any of below mutual funds and start invest 2000 rupees in first year, 2200 in second year, 2500 in third year and 10% increase in each consecutive years.

- UTI Nifty Next 50 Index Growth Direct Plan

- ICICI Prudential Nifty Next 50 Index Growth Direct Plan

You can start investing in index mutual funds by login to respective mutual funds portal. There is another better and simple alternative to this is mutual fund aggregator portal. You can invest in all these mutual funds by login to any one of the aggregator portails, Groww, Kuvera, PayTM money, ET money and Zerodha coin allows to invest all the mutual funds in one portal. Investing 5000 rupees monthly in index mutual funds would give better returns in long term. It requires patience and disciple in investment. Start today by login to mutual fund portal.