Indian people would look for risk free investment and finally they would select fixed deposit. They would plan their tax planning in fixed deposit and never think of investment in long term financial goals. Fixed deposits never make you rich. So come out of fixed deposit trap and start investment. This post will discuss “is Fixed deposit good investment?”.

Investing on fixed deposits, Post office saving scheme, Senior citizen saving scheme, PPF and Sukanya samriddhi account. These investment gives fixed returns and but it is not worth in long term. Inflation makes all these investment are unworthy. People never consider inflation when they start their investment. To know the actual returns from investment, you have to measure with buying power of the money.

Fixed deposit has inflation risk

Let us take an example milk price. In 2008, one litre milk is 15 rupees. 2021 it is 42 rupees. If you invested the 15 rupees in post office saving scheme for yearly interest 7%, it would become 35 rupees. But milk price is 42 rupees. So whatever money you deposited in post office scheme may look like investment, but it is not investment. I haven’t considered the TDS on this returns. If you consider the TDS, it would become 32 rupees. Fixed deposit rates in post office is 7%.

2008 : 15 rupees invested => 32 rupees in 2021 in post office scheme

2021 : 15 rupees milk would be 42 rupees in 2021.

How to come out of FD trap:

So how to get out of this trap. The only way to become rich is investing on hard assets. Assets like Gold, stocks, equity mutual funds or real estate. These investment has risk associated based on economy, market sentiment and demand. But these investments gives real returns and adjust based on inflation. Really you want to become rich, start investing in hard assets. For instance, saving for your child’s higher education that’s 15 years away through FDs may not effective as of post-tax interest rate of an FD.

Do not keep your money in fixed deposit in case your goals is 5 years and above.

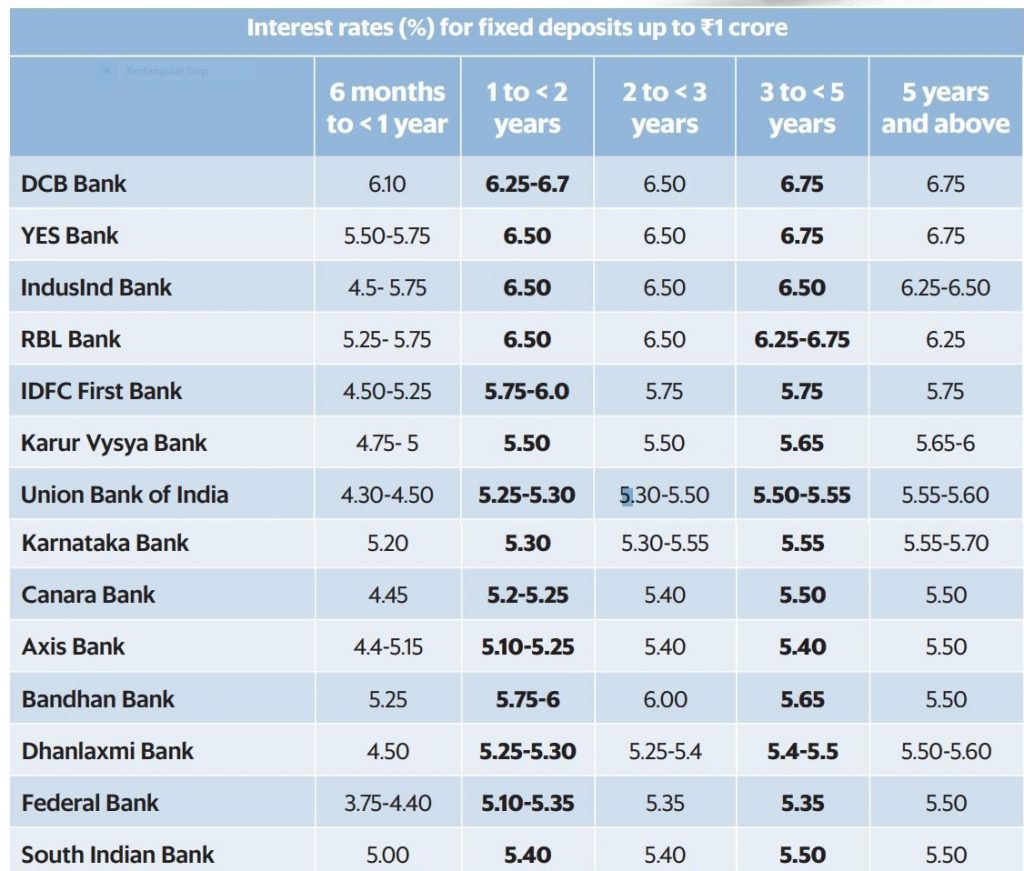

If you plan to take holiday in 2 years or planning to buy gold jewelry in one year, an FD can help. “Mint” financial daily published an data on fixed deposit rates( Thanks to livemint). You would get maximum 6.75% in fixed deposit and India inflation rate is 5% in 2020. Food inflation jumps to 8% in 2020.

The buying power of money shows you actual returns.

Disadvantages of investing in Fixed Deposit:

- The biggest disadvantage of FD is its return will not able to beat the inflation. Interest rate of FD is 6% to 8% max. Inflation is considered as 7%. So the real rate of return is marginal.

- Interest earned from FD is taxable in the hands of the investor. It is an obligation on the investor to pay his tax FD interest according to his tax slab. So this product is not at all suitable for those who are from the highest bracket as their real rate of return will be negative after considering inflation and tax.

- In case of emergency if you break your FD before its maturity you have to pay 1% penalty. The penalty amount will be deducted from the interest earned up to that date.

- In case of greed to earn more interest if you put your money in any small cooperative bank or Patpedhi (very small bank) your FD is at risk. Not only interest but the principal may also have defaulted.

- The government has guaranteed interest security up to 10000 rs only for the reputed government and private bank Fixed Deposits too. So it means FD is not fully secured in case of default by the bank due to its bad financial position.

- Investor thinks that FD is a risk-free investment option but it carries a risk which is called inflation risk.

So what is action plan to become rich. 15% of your investment in gold and remaining in equity mutual funds or stock market. In case you have confusion on selecting the best mutual funds to invest, start investing on Nifty index and Nifty junior index mutual funds.

15% on Fixed deposit

15% on Gold

15% on Nifty index mutual funds.

15% on Nifty Junior Index mutual funds.

Buy gold and start your investment in mutual funds and stock market.