Indian investors gives more preference to LIC or ULIP insurance plans. They think it is safe and government handles their money. But it is not efficient way of securing your family expenses and risk cover. There is better alternative to insurance plans or ULIP linked insurance plans. Smart alternative is Term insurance + Tax saving Mutual funds. Plan your risk cover and long term investment with mutual funds.

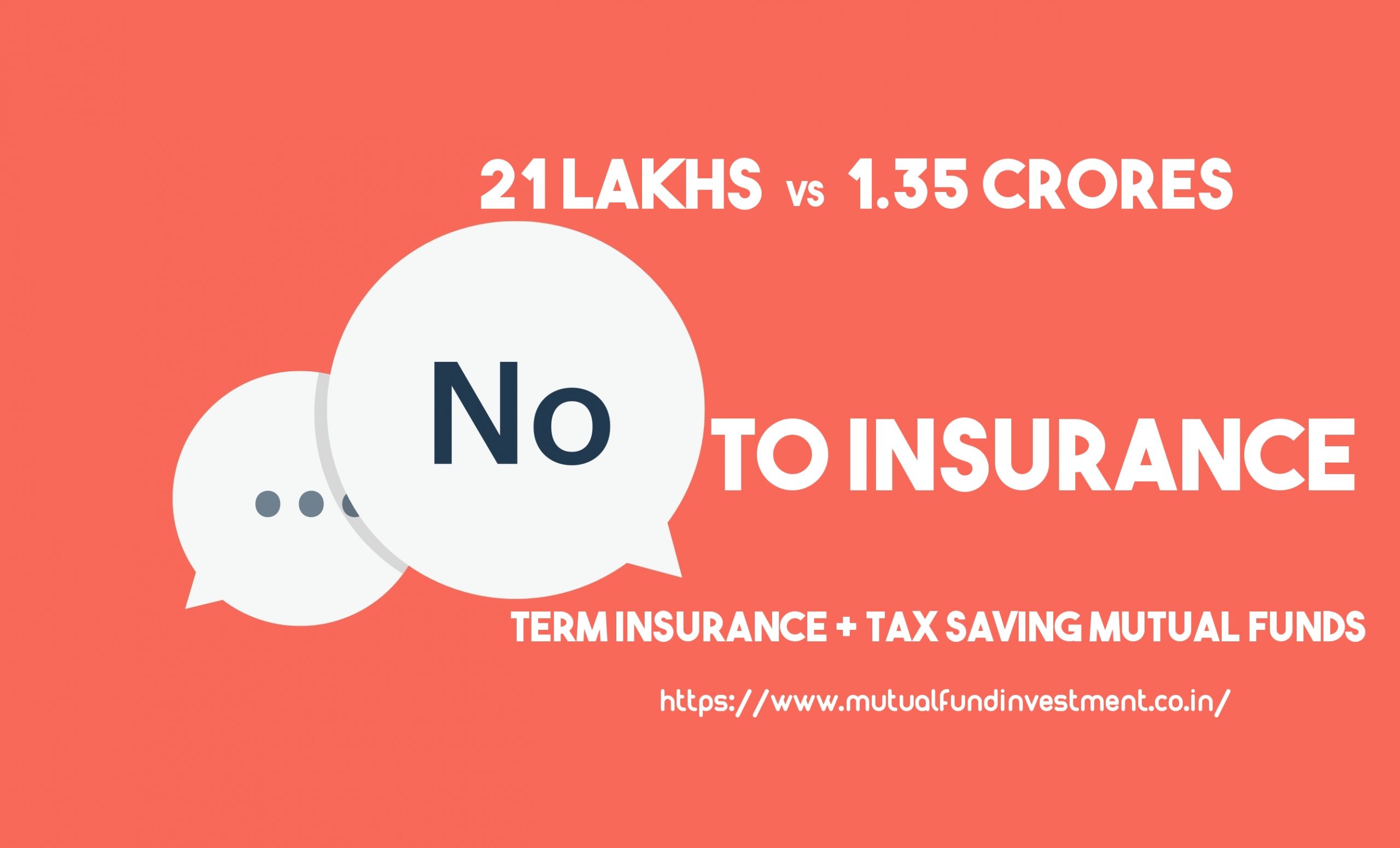

Let us take an example, if 30 years old Indian investor takes LIC for 20 years with monthly premium of Rs.5000 would get totally 21 lakhs as maturity amount.

5000 * 20 * 12 = Approx 11 Lakhs.(Total Invested Amount)

Bonus = Approx 10 Lakhs.

Total maturity = Approx 21 lakhs.(Total amount after 20 years)

Insurance is not an investment, it is life coverage.

But Let us split the amount into two part 1500 rupees and 3500 rupees.

For 30 years investor,

1500 rupees in Term insurance, would cover 1 Crore.

3500 rupees in ELSS mutual fund for 20 years, would return 35 Lakhs. ( Assume average MF return 12%)

Totally 1 Crore risk coverage and 35 Lakhs return after 20 years in mutual fund.

TERM INSURANCE + ELSS MUTUAL FUNDS INVESTMENTs ARE TAX EXEMPTED UNDER SECTION 80C.

Same investment of monthly 5000 rupees, LIC/ULIP returns 21 to 30 Lakhs approx. But Term insurance + mutual fund gives coverage and lump sum return for your family around 1 Crore Risk cover and 35 rupees lump sum.

Insurance premium should be 5% of your monthly income, maximum 10% of your income

You should invest in the best mutual funds in the market. You can also pickup some interesting equity mutual fund themes and let the fund managers produce good returns as your investment for long term. Term insurance plan is the simplest form of insurance, which in case of a policyholder’s demise, ensures that the family gets the sum assured. It offers risk coverage for the duration of the policy Term. The Sum Assured is paid to the beneficiary who is nominated by a policyholder. This is paid out as a lump sum amount or a combination of lump sum and monthly amount based on the plan chosen.

A term life insurance plan is a fixed-period and fixed-benefit plan. That implies, it provides pure risk cover for a definite period that is, 5, 10, 15, 20 or 30 years, as chosen by the insured. As well as the benefit to be received as sum insured at the time of death, is fixed.

Advantages of Term Insurance Plans:

- It is an investment-free tool, hence no complex calculations.

- It is the most economical way to get life insurance with Opportunity for higher Sum Assured

- Cheap and inexpensive, very low premiums for a very high sum assured.

- Financial security is provided to the family in case of the unfortunate event

- Tax exemption on the premium paid under section 80C.

- Convenience of purchase, Easy to buy the Term insurance online or offline.

- Many policy gives you an option to cover till 75 or 80 yrs of age

Assuming you are 40 years of age, male and a non-smoker, and taking into account the rest of the details given by you, Edelweiss Tokio Life – MyLife+ will give you a Sum Assured of 50 lacs at a premium of Rs.10700/. This translates to less than Rs.900/- p.m which is the minimum cost for one time food at restaurant. Below list of popular Term insurance offers in india,

- ICICI Prudential iProtect Smart

- LIC e-Term

- Max Life Online Term Plan Plus

- Kotak Life Preferred e-Term Plan

- Edelweiss Tokio Life TotalSecure+

- HDFC Life Click2Protect 3D Plus

Advantages of ELSS mutual funds :

- Tax exemption under income tax section 80C

- Better investment in long term

- 3 Years lock-in period.

- Invests in equity market for better returns.

- Managed by financial experts.

Plan Mutual Fund + Term insurance. Take Smart Decisions. Happy Planning. !!

How to get 3 months basic salary as Covid 19 advance from PF account