Indian taxpayers often look for different tax saver options to help reduce the taxation burden. Equity Linked Savings Scheme (ELSS) is one such major tax-saver option for Indian taxpayers. Equity Linked Savings Scheme (ELSS) funds are open-ended equity-oriented schemes that are offered as tax saving options. This mutual fund scheme is part of the tax benefits under the 80C section ...

Trading and investing are way to make profit in the stock market, but they pursue that goal in different ways. Retail investors enter into market without understanding the different between these two and loss money in the market. Before enter into market they have to decide they want to become investor or trader? This will make you as investor. Are ...

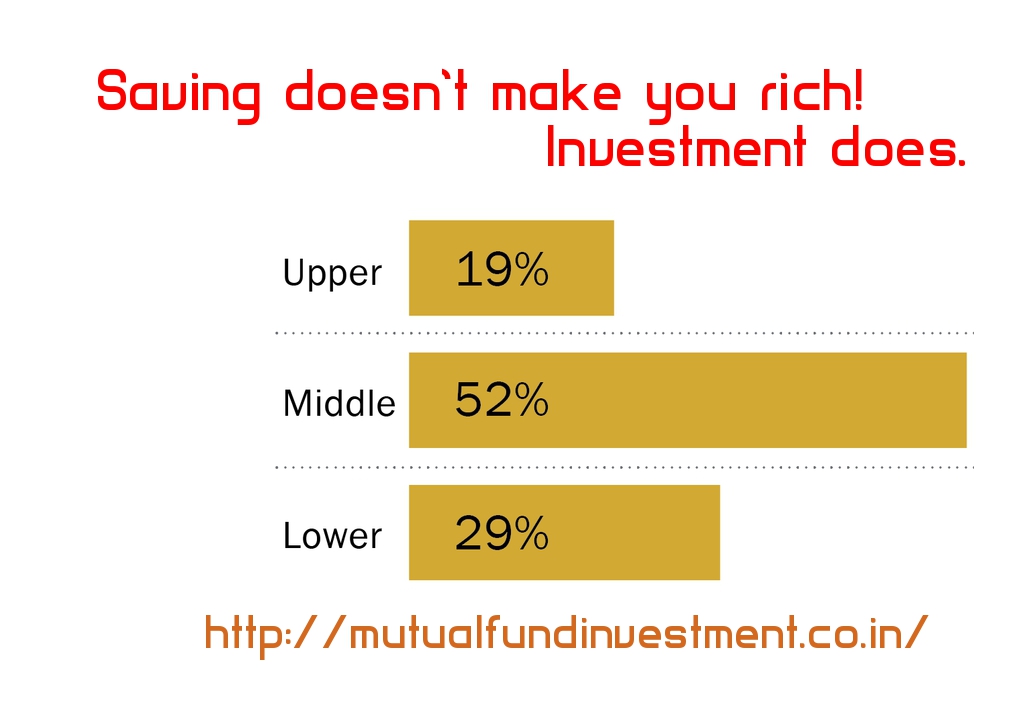

Most of the time, indian people are not clear on proper investment tool for financial goals. They select wrong investment option such as Investing in stock or equity mutual fund for short term investments (or) FD for 10 years. Fixed deposit is not an investment tool for 10 years investment. Money would grow slowly in fixed deposit against inflation. So ...

Why Mutual fund Investment is Best in India: Mutual fund is a simple, tax efficient and effective tool to invest for your goals. Mutual fund investment are monitored by fund managers, it is diversified, simple to start, easy to get money by selling mutual fund units ,tax saving ELSS fund, Tax free returns from equity mutual funds and monitored by ...