What is Mutual Fund:

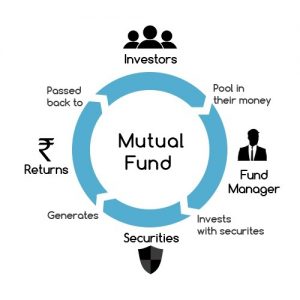

Mutual fund is a simple, tax efficient and effective tool to invest for your goals. Mutual fund collection of stocks or bonds that a professional Fund Manager buys on behalf of you. Fund Manager decides which stock or bond to buy and how much. A mutual fund then distributes the entire investment amount in small units (called units). Investors can buy these units instead of buying stocks directly.I do not see any other investment tool achieve your goal as simple as with mutual funds.

Everywhere mutual fund ads shows disclaimer.

‘Mutual Fund investments are subject to market risk. Please read the offer document carefully before investing’

Do not get scared by the disclaimer,

“DRIVING IS RISK. BUT AFTER LEARNING DRIVING, WE EXPERIENCE JOYFUL JOURNEY. SAME APPLIES FOR MUTUAL FUND AS WELL. LEARN MUTUAL FUND AND ENJOY FINANCIALLY RICH LIFE.”

Managed By Fund Manager:

A mutual fund is a managed by financial experts(fund managers) and offered by AMC(Asset Management Company ). AMC collects money from investors(like you) and invest the collected money in stocks, bonds, short-term money market instruments and commodities such as precious metals by grouping money based on investor interest. Investors in a mutual fund have a common financial goal and their money is invested in different asset classes in accordance with the fund’s investment objective.

An asset management company (AMC) is a company that invests its clients’ pooled funds into securities that match declared financial objectives. Asset management companies provide investors with more diversification and investing options than they would have by themselves. AMCs manage mutual funds, hedge funds and pension plans, and these companies earn income by charging service fees or commissions to their clients.

Main advantage of mutual funds is AMC collects small amount(starts from 500 rupees) from group of investors and give it to finance professionals control their money. So small investor gets benefit of having financial experts(Fund managers).Mutual funds present an option for investors who lack of knowledge to make traditional and complex investment decisions. By putting your money in a mutual fund, you permit the portfolio manager to make those essential decisions for you.

For example, you invest 1000 rupees per month in mutual fund. The AMC collects 1000 rupees from each of 10000 investors and 10000000(One Crore Rupees) in stock market or bonds. Fund manager invest 1 crore in market and share the profit to each investor.

1000 rupees * 10000 investor in single mutual fund = 10000000(One Crore Rupees)

Fund manager invests one crore and gets 10 lakhs rupees as a profit.

He shares the profit 100 rupees to each investor. So 1000 rupees becomes 1100 rupees.

Now you clear about role of fund manager and how he grows the invested money in mutual fund.In mutual fund,

“More than market risks, fund manager and his approach matters”

Diversification:

Mutual fund are generally well diversified and it reduces the risk of market loss. For instance, if you invests 10000 rupees in software sector mutual fund, The fund manager may invest the pooled money in software equities(stocks). Fund manager may invest that 10000 rupees as below,

2000 rupees in Wipro

1000 rupees in Infosys

3000 rupees in HCL

1500 rupees in TCS

1500 rupees in TechMahindra

1000 rupees in L & T infotech.

Have you ever seen such diversification in any of investment. your 10000 rupees invested in different companies stock and managed by fund manager. All the transaction of buying and selling of the stocks are managed by fund manager as he monitors the stock markets.

The same applies for all the mutual funds. For instance we can take another mutual fund “SBI Magnum Midcap Fund” and invest 1000 rupees in the mutual fund. The mutual fund manager invest the money in different midcap stocks for growth opportunities. The fund manager may decide your 1000 to invest as follow,(just assumption).

200 rupees in Dixon – Manufacturing.

100 rupees in Ramco Cement – Cement

300 rupees in Federal bank – Bank

150 rupees in UPL – Chemicals

150 rupees in Dr. Lal lab – Pharmacy

100 rupees in IGL – Oil & Gas.

Your 1000 rupees invested in diversified portfolios and it gives best growth opportunities as the profit would be reinvested again. So it is growing like compound interest. Finally we are receiving profit from profit in growth mutual funds.

“Compound interest is the eighth wonder of the world.”

Simple to Start Mutual Fund :

Buying mutual fund would be very simple. It requires just PAN CARD ,Address proof and identity proof with saving account information to start SIP or lumpsum investment. Note no DEMAT account required to invest mutual fund. Mutual fund investment is very simple and there are more than lakh financial folks from AMC ready to help us to initiate the mutual fund investment.

You know where your money invested:

Each mutual fund publish the report on mutual fund investment. From the report we can know investment securities buy or sell for that mutual funds. So it is not a gambling or not a hidden process.

Your investment being monitored by SEBI:

Securities and Exchange Board of India(SEBI) is the regulator for the securities market in India. All mutual fund investment being monitored by SEBI for the regulations. So you can trust AMC on mutual fund investments.

Sell the mutual fund when you require money:

Selling the mutual fund would be very easy. The fund manager and AMC would return money. you can sell them online any time, without any problem.

Get Tax-Free return from Mutual Funds:

Equity Mutual Funds(In simple terms invested in stock markets) where at least 85% of total AUM (Assets under management) of respective funds invested into Equity or Equity linked products (Fund Of Funds, ETF etc). Any investment, where investor stay invested for at least a year would be tax exempt.Any investment in Equity Mutual funds for more than 1 year comes under long term capital gain tax – and it is zero!

Save Tax by investing in ELSS fund(80C investment) :

While tax planning may seem to be a difficult process, Mutual Funds offer you a simple way to get tax benefits, while aiming to make the most of the potential of the equity markets. An Equity Linked Savings Scheme (ELSS) is an open-ended Equity Mutual Fund that doesn’t just help you save tax, but also gives you an opportunity to grow your money. It qualifies for tax exemptions under section (u/s) 80C of the Indian Income Tax Act.

- An opportunity to grow your money by investing in the equity market.

- The lock-in period is only 3 years.

- You can invest monthly or weekly through a Systematic Investment Plan

- It is tax saving + investment.

PPF returns 8.70% and 8.80% annually. But ELSS fund may return more than 15% average based on market condition. So analyze properly and invest in best ELSS fund to get best returns.Each AMC offers tax saving ELSS fund. For example below ELSS fund offer by AXIS fund, DSP blackrock, Franklin Mutual fund hours and Birla sun life mutual fund house.

Axis Long Term Equity Fund

DSP Blackrock Tax Saver Fund

Franklin India Taxshield

Birla Sun Life Tax Relief ’96

You can select your tax saving mutual fund by analysis of each fund. We will guide you how to analyze the mutual fund in upcoming sections.

MUTUAL FUND IS NOT ONLY A FINANCIAL TERM. IT IS SMART INVESTMENT AVAILABLE IN INDIA. NOT ONLY SMART, THE BEST INVESTMENT. MUTUAL FUNDS!!!

Happy Learning.!!!